Boulder County + Denver Metro Housing Market Report

July 23 Real Estate Statistics – Denver Metro

HIGHLIGHTS

Overall Market Outlook and What This Means for Buyers and Sellers: Opportunities for Both

- According to US News, despite continuous interest rate hikes, the US Economy grew at an annual rate of 2.4% in the second quarter of this year, which was well ahead of estimates.

- Consumer spending and a strong labor market appear to have contributed to this growth, and FED staff member Jerome Powel noted that the FED now does not consider a recession likely this year.

- Many economists still believe labor markets will likely soften throughout the third and fourth quarters of 2023, and the possibility of additional interest rate hikes remains ever-present.

- This combination may slow economic growth in this year’s third and fourth quarters.

- This combination may slow economic growth in this year’s third and fourth quarters.

- In part due to the US economy’s surprising resilience to interest rate hikes, housing affordability continues to be an issue, especially in markets experiencing large economic growth and an influx of out-of-state Buyers.

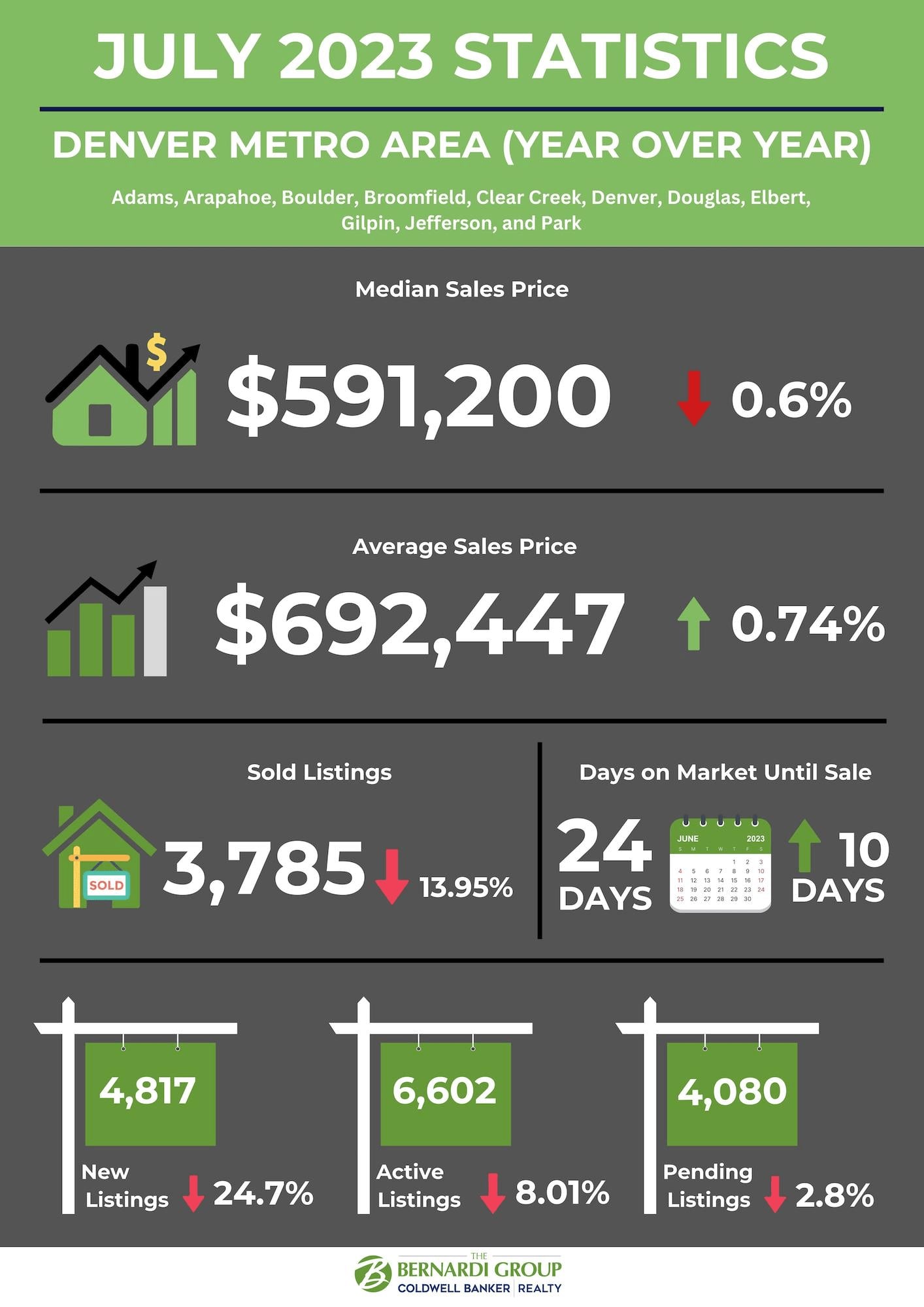

- Additionally, active inventory remains relatively low, with just a nominal increase (5) over the past month in the Denver Metro area but an overall 8.3% decrease in homes for sale in Colorado year over year.

- This is perhaps due to Seller hesitations in moving from homes with locked-in, lower interest rates, and those that do not need to sell deciding to hold off on making any moves.

- Additionally, active inventory remains relatively low, with just a nominal increase (5) over the past month in the Denver Metro area but an overall 8.3% decrease in homes for sale in Colorado year over year.

- Without a significant increase in inventory, we can expect prices to remain relatively steady.

- It should be noted that Colorado Home prices, on average, are down 3.9% year over year but with the exceptional and unprecedented appreciation we’ve experienced over the past three years, many property owners still have significant equity in their homes.Certain geographic areas and price points also seem somewhat insulated from this overall trend. We have seen desirable, well-priced properties receive multiple offers even after longer days on the market.

- With lower inventory and higher mortgage rates, the US housing market is considered among the economy’s “weakest links” regarding a slowdown as many Buyers and Sellers are deciding to sit on the sidelines.

- It should be noted that Colorado Home prices, on average, are down 3.9% year over year but with the exceptional and unprecedented appreciation we’ve experienced over the past three years, many property owners still have significant equity in their homes.Certain geographic areas and price points also seem somewhat insulated from this overall trend. We have seen desirable, well-priced properties receive multiple offers even after longer days on the market.

So what does all this mean for current Buyers and Sellers in this market?

- There is opportunity on both ends.

- Low inventory still allows Sellers to get a competitive price on their homes.

- Historically, there is also a spike in Buyer activity after summer travel has ended and the school year begins.

- This means mid to late August is an excellent time to put your home on the market.

- Low inventory still allows Sellers to get a competitive price on their homes.

- For Buyers, interest rates will not be going down anytime soon, and there may even be the potential for additional spikes.

- While more tentative Buyers adjust to this drastic change, now is a good time for motivated Buyers to make their move and lock into the market.

- Those who are motivated will experience less competition, which ultimately gives Buyers strengthened negotiating power not only when submitting offers but also with inspection negotiations for the first time in several years.

- While more tentative Buyers adjust to this drastic change, now is a good time for motivated Buyers to make their move and lock into the market.